In a world dominated by financial uncertainties, the need for effective money management tools has never been greater. Rocket Money, a popular budgeting app, is making waves in the financial landscape with its innovative features and user-friendly interface. The recent Rocket Money ad has caught the attention of many, showcasing how this app can simplify financial planning and help users take control of their financial future. With the rapid advancement of technology, financial applications have evolved to meet the growing demands of consumers. Rocket Money stands out as a shining example of how tech can be harnessed to promote financial literacy and provide a seamless budgeting experience.

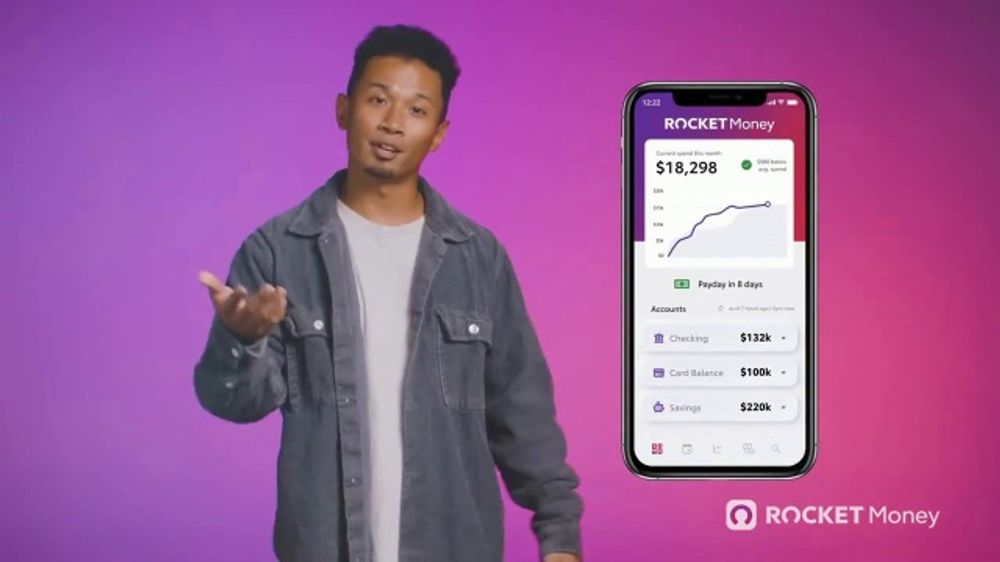

As the Rocket Money ad continues to circulate across various media platforms, it emphasizes the importance of understanding spending habits, setting financial goals, and tracking progress. The ad highlights the app's key features, such as automatic expense tracking, personalized budgeting, and insightful reports, all designed to empower users in making informed financial decisions. In this article, we will delve deeper into the Rocket Money ad, exploring its messaging and the impact it has on potential users.

Furthermore, we will address the common questions surrounding Rocket Money, its functionality, and how it can revolutionize the way individuals approach their finances. The goal is to provide a comprehensive understanding of Rocket Money and why it has become a go-to solution for many seeking financial clarity and organization.

What is Rocket Money and How Does it Work?

Rocket Money, formerly known as Truebill, is a financial management app that helps users track their spending, manage subscriptions, and budget effectively. By linking bank accounts and credit cards, Rocket Money automates the expense tracking process, allowing users to see where their money goes in real-time. The app also offers features such as bill negotiation and subscription monitoring, making it easier for users to save money and avoid unnecessary charges.

Key Features of the Rocket Money App

- Automatic Expense Tracking: Rocket Money automatically categorizes transactions, giving users a clear overview of their spending habits.

- Personalized Budgets: Users can set customized budgets based on their income and expenses, helping them stay on track financially.

- Subscription Management: The app identifies recurring charges, allowing users to manage and cancel unwanted subscriptions with ease.

- Bill Negotiation: Rocket Money offers a bill negotiation service, helping users save on monthly bills by negotiating better rates.

What Makes the Rocket Money Ad Stand Out?

The Rocket Money ad has gained attention due to its engaging visuals and relatable messaging. It effectively communicates the app's benefits, making it appealing to a broad audience. The ad emphasizes the importance of financial awareness and encourages viewers to take control of their finances. Additionally, the use of real user testimonials adds credibility to the claims made in the ad, helping potential users relate to the experiences shared.

Who Can Benefit from Using Rocket Money?

Rocket Money is designed for anyone looking to improve their financial habits. Whether you're a student managing your first budget, a young professional navigating expenses, or an established individual seeking to optimize savings, Rocket Money offers valuable tools to suit various financial needs. The app's simplicity and accessibility make it a great choice for users of all ages and financial backgrounds.

Is Rocket Money Secure and Reliable?

Security is a top priority for Rocket Money. The app employs bank-level encryption and security measures to protect users' sensitive financial information. Additionally, Rocket Money is compliant with financial regulations to ensure that users can trust the app with their data. Regular updates and security audits further enhance the app's reliability, making it a safe choice for managing personal finances.

How Can Users Get Started with Rocket Money?

Getting started with Rocket Money is a straightforward process. Users can download the app from their respective app stores and create an account by providing basic information. After linking their bank accounts and credit cards, the app will begin tracking expenses automatically. Users can then customize their budgets and explore the various features offered by Rocket Money.

What are the Pricing Plans for Rocket Money?

Rocket Money offers a free version with essential features, making it accessible for users who want to try the app without any commitment. For those seeking advanced features such as bill negotiation and premium budgeting tools, Rocket Money provides a subscription plan at a competitive price. Users can choose between monthly and annual plans, allowing for flexibility in their financial management journey.

Can Rocket Money Help Users Save Money?

Yes, Rocket Money is designed to help users save money by providing insights into spending habits, managing subscriptions, and negotiating bills. By identifying areas where users can cut back on spending, the app empowers individuals to make informed decisions about their finances. Additionally, the subscription management feature helps users avoid unnecessary charges, ultimately leading to increased savings.

Conclusion: Why Choose Rocket Money?

The Rocket Money ad effectively showcases the app's potential to transform the way individuals manage their finances. With its user-friendly interface, robust features, and commitment to security, Rocket Money stands out as a top choice for those seeking financial clarity. By embracing the tools offered by Rocket Money, users can take proactive steps towards achieving their financial goals and improving their overall financial health.

ncG1vNJzZmivp6x7rK3PrKqnZpOkunCv1KWroq6RqbJuvM6soK2hppp6qa3BoqusZ6KksKyx02akqKaVrnqisI2hq6ak